Get Acquainted with Soteris

Our Purpose

Founded in 2018, insurtech, Soteris introduced a new method of precise, policy-level auto insurance risk selection, driven by machine learning.

Our name is inspired by the Greek god/goddess pair, Soter and Soteria. Like insurers, Soter and Soteria personify safety, salvation and deliverance from harm.

Soteris was founded with the goal of helping insurers improve profitability with data-driven risk selection. When insurers have the insights needed to select risks individually and based on rate adequacy, they are free to focus on their core mission of safeguarding policyholders.

Our model has been proven by several customers to help drive down loss ratio.

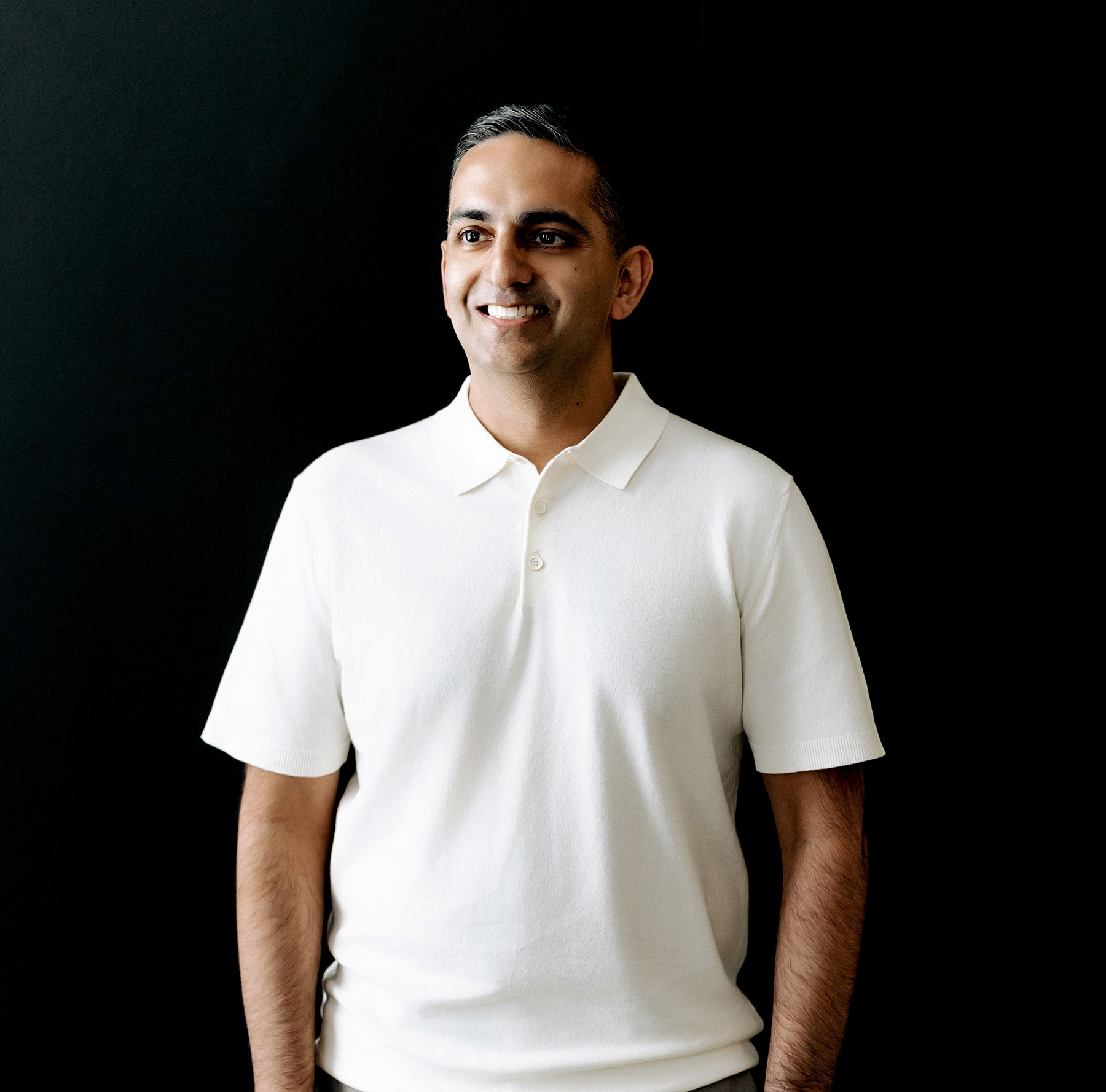

About Our Founder

Soteris is the brainchild of founder and CEO, Sunit Shah, PhD.

Sunit is a co-author of the Wiley textbook, Behavioral Finance and the author of the CFA book, The Principal-Agent Problem in Finance.

In an earlier role, Sunit analyzed and identified trading opportunities within interest rates, currencies, equity indices, energy, agriculture, precious metals, base metals, and softs as the second-in-command on the macro and commodities portfolio.

In 2018, he founded Soteris, applying his knowledge of trading algorithms to create machine learning software that predicts insurance losses with a high degree of accuracy.

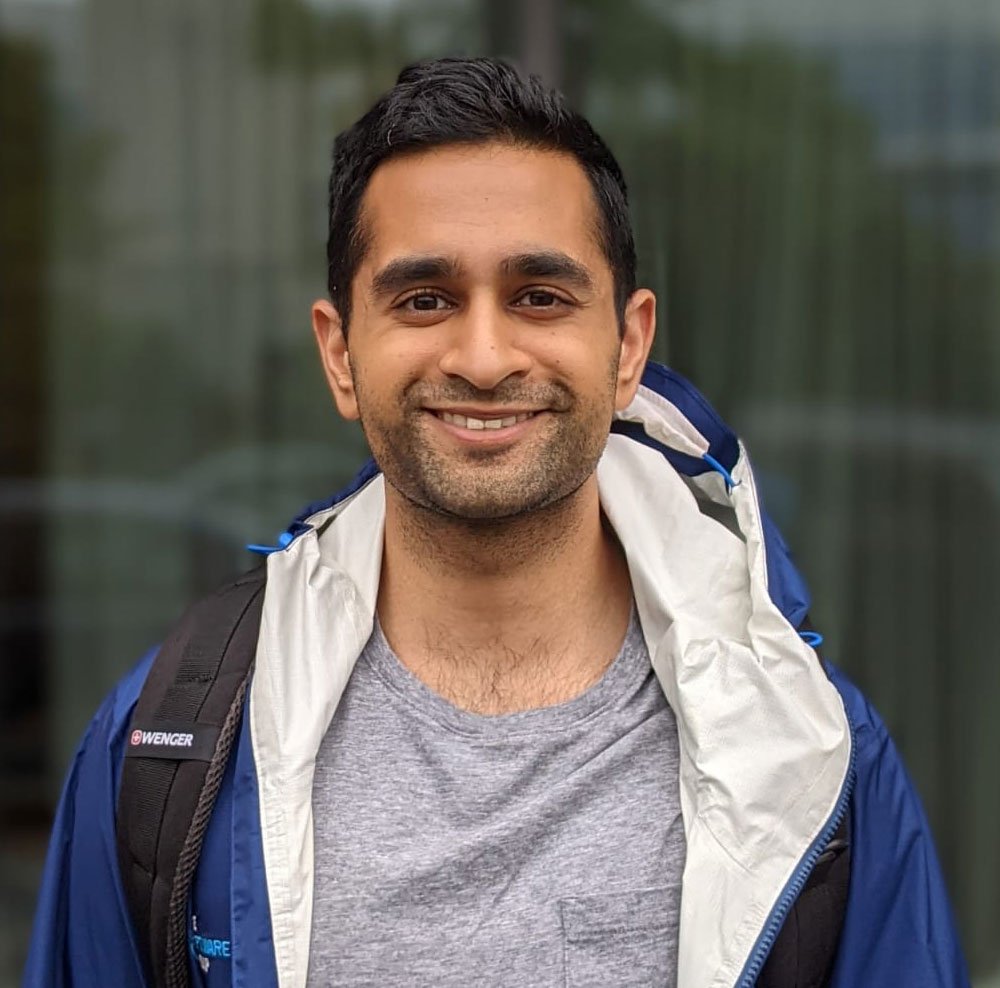

Meet Our Team

John Baker

Head of Sales

Tom Steffes

Infrastructure Engineer

Sam Wilson

Machine Learning Engineer

Sai Haran

Machine Learning Engineer

How Soteris is Changing Underwriting Paradigms

The Status Quo

Rely on underwriting rules & third-party data integrations to predict potential for loss.

The Soteris Way

Build an algorithm based on your own data to more accurately predict your loss drivers.

The Status Quo

File new rates for entire segments of business, charging every policyholder more and driving lower-risk policyholders to competitors.

The Soteris Way

Quote only the adequately-rated policies and avoid incurring the losses of your most underpriced risks.

The Status Quo

Turn off entire segments of business and reduce written premium to improve your loss ratio.

The Soteris Way

Turn all segments on and grow your written premium while you’re improving your loss ratio.

The Status Quo

Focus underwriting efforts on addressing high-risk policies.

The Soteris Way

Use the Soteris algorithm to better understand risks, and make sure you’re right-priced for every policy, receiving the optimal premium for both low and high-risk accounts.